- BOND FINANCIAL CALCULATORS HOW TO

- BOND FINANCIAL CALCULATORS LICENSE

- BOND FINANCIAL CALCULATORS FREE

This is because corporate bonds are associated with credit risks since they can default. We can point you in the right direction or create what you need. If you don't see what you need email or call us.

BOND FINANCIAL CALCULATORS LICENSE

We also provide these financial calculators to license on your website or financial product.

BOND FINANCIAL CALCULATORS FREE

The higher the risks of the bond, the lower the price, holding all else constant.Ĭorporate bonds tend to be riskier than otherwise similar government bonds. We have over 400 financial calculators at Our website is free for you to use and visit as often as you like. What rate of return have you earned on your Premium Bonds to date Borrowing Calculators. You can view details and links to all the calculators below. The higher the coupon rate, the higher the price, holding all else constant. With 66 Candid Money financial calculators to choose from, theres likely one to suit your needs. This depends on the coupon rates and the risks of the bond. Specifically, the bond price increases when the interest rates go down and vice versa.īond prices can be either higher than or lower than their face value. When the central banks, such as the Federal Reserve and the Bank of England, change their interest rate policies, the bond prices fluctuate. Here are a few insights we wish to share with you:īond prices are massively affected by the macroeconomic environment, especially interest rates.

BOND FINANCIAL CALCULATORS HOW TO

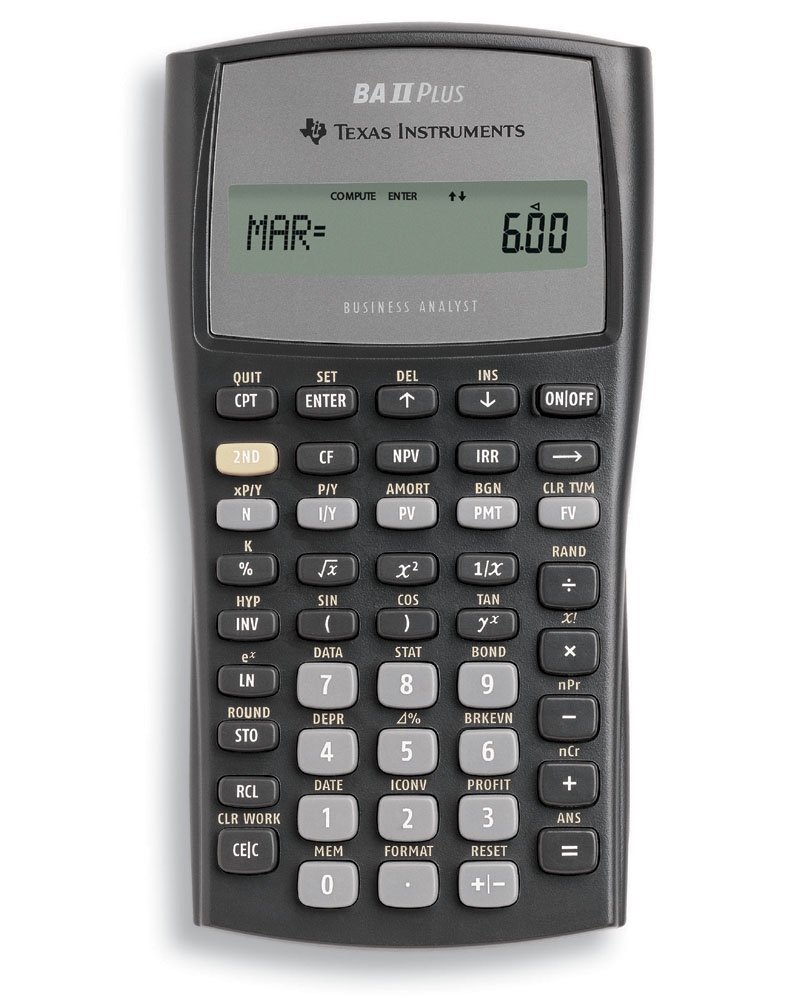

Now that you understand the meaning of bond price and how to find bond price. In our bond price calculator, you can follow the present values of payments on the bond price chart for a given period. In this example, YTM = 8%.Īs mentioned above, the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price equation below:īond price = $50 / (1 + 8%) 1 + $50 / (1 + 8%) 2 + $50 / (1 + 8%) 3 +. The YTM refers to the internal rate of return (IRR) of a bond, which is a more. This can be done with computer software, a financial calculator, or a present value. The YTM is the annual rate of return that the bond investor will get if they hold the bond from now to when it matures. A bond is a fixed-income investment that represents a loan made by an investor to a borrower, ususally corporate or governmental. The diligence conducted by the lender used the most recent financial. Introduction to Bonds Payable, Bond Interest and Principal Payments. The n is the number of years it takes from the current moment to when the bond matures. It can be calculated using the following formula:Ĭoupon per period = face value * coupon rate / frequencyĪs this is an annual bond, the frequency = 1. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. The face value is the balloon payment a bond investor will receive when the bond matures. The bond valuation calculator follows the steps below: Let's take Bond A issued by Company Alpha as an example. Frequency - The coupon frequency, i.e., the number of times the coupon is distributed in a year.Current yield gives you a quick read of how a bond compares in the market. Other Financial Basics and Bond Calculators. To use bond price equation, you need to input the following data to our current bond price calculator: So, a bond trading at 920 with a face value of 1000 and a 10 interest rate has a 10.87 current yield, higher than the one stated by the bond.

You can see how it changes over time in the bond price chart in our calculator. Importantly, it assumes all payments and coupons are on time (no defaults). It automatically calculates the internal rate of return (IRR) earned on a callable bond assuming it's called at the first possible time. Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. Bond Yield to Call (YTC) Calculator Investing Written by: PK On this page is a bond yield to call calculator.

0 kommentar(er)

0 kommentar(er)